Andy Marken’s Content Insider #186 – Virtual Value

The Real World Value of the Virtual World

After the first social media frenzy you’d think/hope people learned so things won’t go wrong this time around. If understanding is overpowered by greed, things won’t go wrong…they’ll go seriously awry. “The Hangover Part II,” Warner Bros (2011)

A friend recently gave us a flyover of the island he owns out in the middle of the ?????

Another’s son took us on a tour of his farm complete with cows, chickens, pigs, tractors and a horse out in the middle of ????

It was fast, simple, easy…they just went to SecondLife, Farmville respectively and showed us around.

You may think it’s the virtual world, but they paid real money for their property and improvements.

The new round of online, social media fervor/fear is as interesting as the stuff we saw in the 1995-2000 dot-com bubble.

Could it happen again?

Sure…

-

VCs are hungry to recover their early investments

-

Investors are hungry for new technology buzz offerings they don’t understand

-

Underwriters, brokers, investors want some upbeat option to our recent recession

-

People with more money than brains are again looking for the fast bucks

-

Young kids who put in their time (a whole year, two) want their big home in Portola Valley, Los Altos Hills; their sexy race cars; planes/boats like Oracle’s Ellison

There are some good social media companies…there are some great social media companies…there are some cheap copies…there are some duds.

Every one of them started by guys/gals sure they’ll be touched by the financial gods.

All of them feel their enterprise idea is as insanely great as Amazon, Google, Facebook, YouTube, Yandex, Baidu, LinkedIn, Zynga, you name it.

These firms are the same as, yet different from the last bubble.

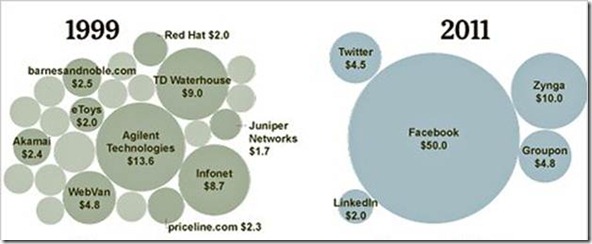

Then, Now – At the height of the dot-com era, 308 companies went public. The 24 largest had a combined market cap of $70.96 billion. This year, a number of highly visible, prominent firms are on the verge of going public with a valuation of $71.3 billion. The social media IPO frenzy has begun. Morgan Stanley

Their value, their worth is in the eye of the beholder.

Different Rules

They aren’t evaluated by conventional standards that determine the value/price of firms like GE, Dell, HP, IBM, Microsoft, Disney, Hilton, Chevron, Acer, Asus, Lenovo and the rest of the tangible hardware, software industries.

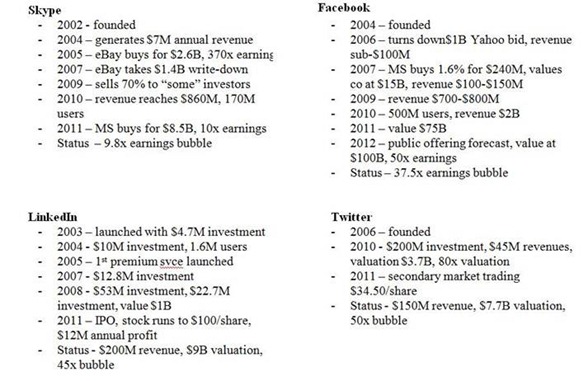

The firms above have a fraction of the frenzy going on now:

Groupon

-

2008 – founded, $4.8M investment

-

2009 – available in 26 cities, $30M investment

-

2010 - $135M investment, $1.3B valuation, $760M revenue, turns down Google’s offer - $6B

-

2011 - $950M investment, $4.75B valuation, preparing IPO for $25B +/-

-

Status - $760M revenue, $4.75B valuation, 32.8x bubble

LinkedIn’s early showing surprised – frightened – normally bullish tech analysts.

Umbrella Effect – LinkedIn’s breathtaking initial public offering (IP0) received a substantial boost thanks to the social media rub-off effect of Facebook. Underwriters and thirsty-for-action investors are eagerly waiting for Facebook to go public this year or next. Already though there is a value proposition question on some of the “secondary” firms. Over-the-top valuations and less than seasoned management teams are making many take a second look at the upcoming social media rollouts. Photo - NYSE

Most of the investors don’t understand the social network but they know it’s hot and it’s here to stay. What it will deliver? They’re not too sure.

If the VCs (venture capitalists) really understood, they would only bet on the winners…not four-five in each category.

The hot-to-go investors don’t want to miss out on owning their part of the social explosion and if they missed out on LinkedIn there are a few more hot properties sitting in the wings just waiting for them to bid on.

Then they’ll own their piece of the virtual world that is changing … everything.

LinkedIn’s Inner Workings

Because it’s now public you can have a closer, better look at the inside of, value of, potential of social media.

LinkedIn may be even easier for professional money holders, money managers, money spenders because it is a professional management, marketing, communications community.

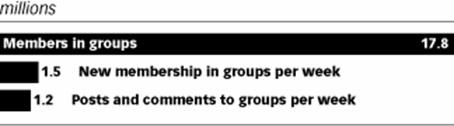

LinkedIn has more than 100 million members with around 25 million U.S. users who visit the site every month. They don’t log in as much as Facebook users; they are active professionals who are more prone to join/post to professional groups.

LinkedIn Groups Metrics Worldwide

Fewer But Better – While LinkedIn has a much smaller membership base than Facebook, investors see a greater potential with the quality of the members and their global distribution. Mashable

As a professionally-oriented networking site it has added value for marketers. These members are more willing to provide more personal information about themselves than the more generic social sites like Facebook.

That means a more focused HR (human relations) and marketing activity can be carried out with more tangible, measurable results.

To improve that value LinkedIn spent a lot of time over the past year developing/launching new services for users and advertisers.

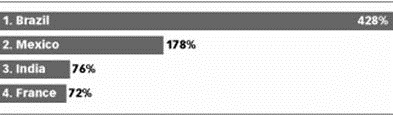

With businesses of all types becoming borderless, LinkedIn has a major presence in the international arena.

Eight years after its official launch, LinkedIn reported the size of the site and its usage.

Global Business

Outside of the U.S. the largest number of members is from India, nine million members. This is followed by Brazil, Canada each with three million members.

Top 4 Countries, Ranked by Fastest-Growing Number of LinkedIn Users

Real Reach – Economists find the LinkedIn membership in BRIC (Brazil, Russia, India, China) to be a key asset to the company’s growth potential. In addition, the membership is professional in nature more than social so it represents a strong global business opportunity. Mashable

Brazil is experiencing the largest LinkedIn membership of new users with 428 percent year-over-year growth.

Companies that are focusing on BRIC (Brazil, Russia, India, China) countries for growth see that LinkedIn has a good foothold in these countries

All of the new social media up-and-comers see global reach as an extremely critical part of their overall survival, growth strategy.

The social media nameplate companies listed above are earning money but are they worth the valuations people are throwing around?

The earnings of today have no relationship with reality!

They may never as long as you…have faith in your parallel universe.

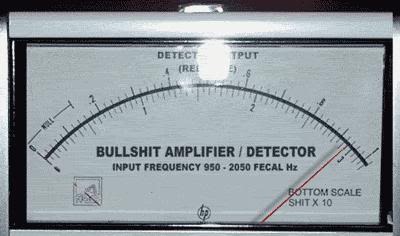

Noise Ratings – The rapid run-up of social media valuations and the excitement surrounding the firms’ offerings/potential offerings leads many to recall the boom/bust of the dot-com era. It’s the same but different…at least these firms have revenue.

Sure, you can measure eyeballs, site visitors, stickiness, mindshare; but do these measurements put money in the cash register at the end of the day? Are they long-term investments?

What about Zynga? Virtual real estate. Games. They have their feet in both sexy camps so maybe…

Of course doesn’t that also say Activision Blizzard is worth a bundle? WoW (World of Warcraft) is the world’s most subscribed MMORPG (Massively multiplayer online role-playing game) with folks spending serious money.

If we look at the last dot-com run-up there are few you can fondly recall – especially if you were an employee or investor.

There’s Amazon and ????

Monetizing

Certainly, social media people like Facebook, Twitter are tracking, analyzing, monetizing their users/visitors about as well as Google. Just ask Zuck – Facebook’s Mark Zucherberger - his folks are turning all of that virtual personal information into real dollars…just ask him.

Are there others that will do it as well?

As Tracy said, “Seriously what is wrong with you three?”

Potential Repeat – It is obviously possible that those who weren’t around for or have forgotten the dot-com ups and downs will get excited and overindulge just as the financial market did back just before 2000. They’ll wake up with a horrible tattoo, monkey, horrible hangover! “The Hangover Part II,” Warner Bros (2011)

The people (users) who buy/visit the parcels, play the games, post/exchange information are real.

So is the money that will be invested in the social media IPOs.

In a few years, the number of social media players will dwindle. The VCs, underwriters will walk away with returns on their investments.

The rest will have…paper.