“I hope you're not busy for about a month...” – Man Stoner, “Up in Smoke,” Paramount, 1978

There was a time when a couple of late teen/early millenniums would get together, max out their credit cards, borrow from their parents and anyone who would listen to them, work (and sometimes sleep) in a garage and emerge with the next great idea.

Not anymore.

Now, they see what someone else has done; give it a new twist, new coat of lipstick, an incomprehensible name and trot off to Sandhill Road and/or other VC (venture capital) organizations around the globe to collect a few hundred million so they can start out in style.

What are they worth?

Billions.

What have they “sold?”

Well, they closed a few or dozen VC deals and have risen to the elite unicorn status.

Isn’t entrepreneurship grand?

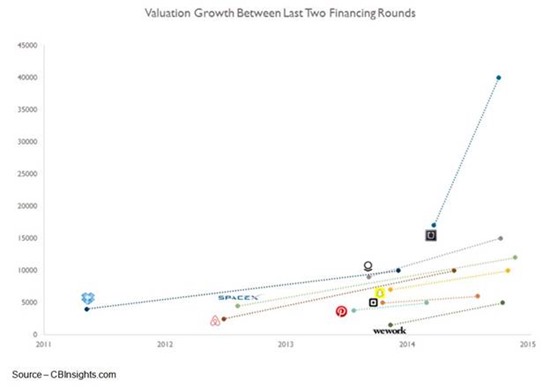

Unicorn status was initially bestowed upon the category of firms valued at over $1B.

Today, the low end is $10B and entry in the club will probably rise to $100B in no time.

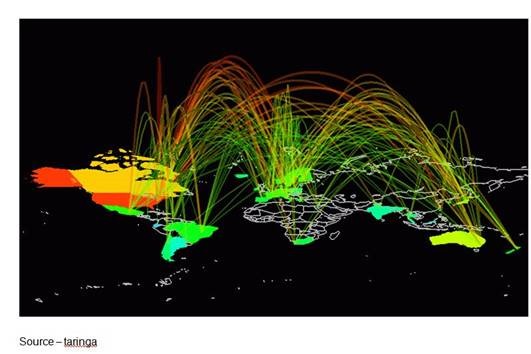

And just think, we can credit this all to the iNet that speeds information around town, around the globe in the blink of an eye.

Global Contact – The Internet may have been designed as a means to help engineers, academics and scientists to exchange information more rapidly; but it has quickly become the tool of commerce and the way folks communicate across the table, across town and across vast oceans. In no time, you can exchange news, data, images; buy/sell goods and make a fool of yourself or insult/abuse people you don’t even know with a click of the mouse. It’s fantastic.

If it weren’t for the used, abused, misused Internet; there would be utter silence.

Instead, every minute:

-

10M ads are displayed

-

500K tweets are sent

-

7M messages sent

-

3.5 pieces of content shared

-

100 hours of video uploaded

-

6.9M Facebook messages sent

-

$134K Amazon sales made

-

1,572,877 GB of IP data transferred

And in two years, there will be 3x more connected things than people on Earth.

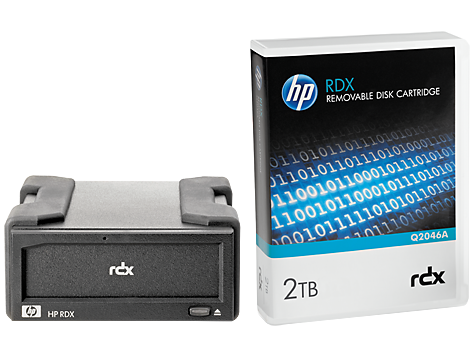

We’ll be driving 13x more mobile traffic and it will all produce more than 5ZB (Zettabytes) of data that has to be stored.

When Pedro was asked how long it would take, he said; “A week. I mean a day. A weekday.”

All on the lowly global backbone and technology that the US government initially funded.

No wonder every government feels entitled to listen in and see what’s going on.

Except for the underappreciated hardware, software and service providers; it’s a regular money-making machine, so why not invest big!

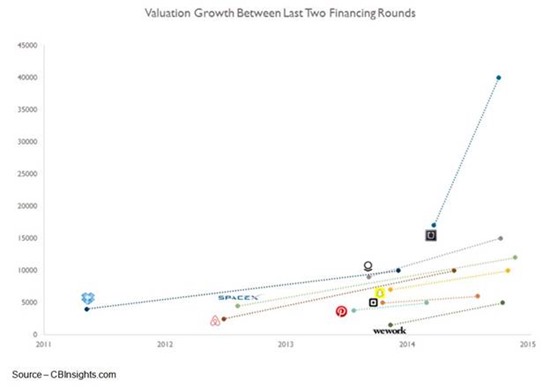

Up, Up and Away – New start-ups get funded almost every day because they have a new idea, new way to interest/attract people that will make all of the early stage investors (and early employees) amazingly rich for only a few hundred million dollars invested. Funds are rushing to get on the table early before the stakes go up.

Of course, not all of them will survive to go public; but VCs don’t care, which is why they invest in 10 or so of the same thing.

If the company burns through the paltry $40 - $80M too quickly, no problem … they simply go back and dip into the money well with an even bigger idea and they’re good for another couple of years.

After all, look at their valuation.

Besides, they’re private firms so they don’t have to play by the same rules public companies have with things like quarterly filings, SEC (Securities and Exchange Commission) documents like audited numbers of real users (not deceased, one timers), real traffic (not bots), revenues and burn rate (how fast you’re going through the stash of cash).

That’s one of the perks of being private vs. public.

You don’t have to tell them a **** thing if you don’t want to!

So folks can let their imaginations go wild … and they do.

Beauty is in the eye of the beholder, so get in before this sucka’ goes ballistic.

None of them heard Man Stoner’s warning, “Hey, hey don't take those, man.”

Of course, it may not take off because history has an ugly way of repeating itself in business.

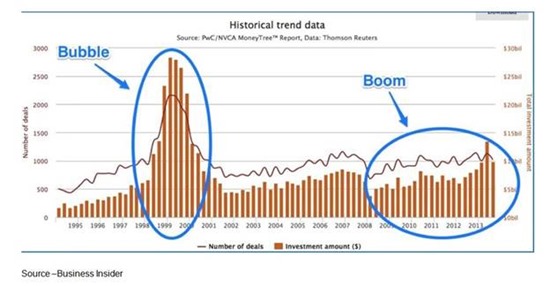

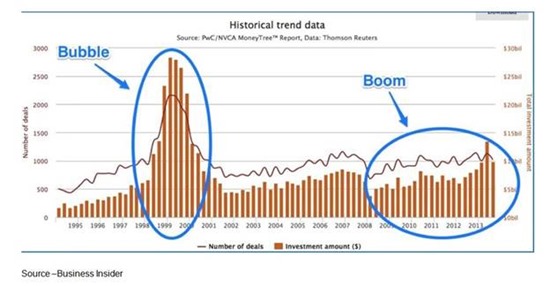

That’s So Yesterday – While the industry may have experienced a bubble/burst situation a few years ago, there’s no reason to think the rapid advance of unicorn firms will encounter the same disaster. Of course, there’s no reason to think it won’t happen again either.

Back in 1999-2000, we had this thing called the dot.com bubble.

It was a beautiful thing – pixie dust, rainbows and good times that would go on forever.

Until they didn’t.

Back in those days, people were betting huge sums of money on young companies run by folks with no track record in business who found it fun and easy to spend the chunks of cash people gave them.

Talking about today’s environment but sounding a lot like the ‘90s, Bill Gurley, a VC, told the SXSW (South by Southwest) folks, “There is no fear in Silicon Valley right now. A complete absence of fear.”

Of course, there are entrepreneurs who didn’t take the easy route to getting their ideas off the ground and growing their firms.

Take Daymond John, of Shark Tank, and Larry O’Connor, of OWC.

John, of Shark Tank, started a clothing line called FUBU (For Us By You) with a second mortgage on the house he and his mother shared. He likes to look at boring things like COG (cost of goods) and sales, margins instead of nebulous numbers like somehow getting one percent of a $50B market.

He doesn’t think the idea of dropping $1M on 100 untested/unproven companies or management teams is a really swift move.

Being in line with comparables in the market (revenues and spending) doesn’t mean much when the market correction comes … and it will come.

Actually, he calls it “dumb money.”

Like most successful entrepreneurs today, both John and O’Connor had an idea, believed in it, and found a way to make it happen.

When he was “tuning” Apple computers back in 1988, O’Connor thought improving systems was too expensive and something most users could do themselves with the right “stuff.” He started OWC (Other World Computing).in his folk’s kitchen and barn.

He continued growing the product lines for the Apple, Apple II and beyond systems. Today, he and his team focuses on good products, customer value, customer service and … oh yeah, retained earnings.

Fortunately, there are a lot of great firms like FUBU and OWC today that have deep roots and resist the temptation of the fast/easy money route. They always remember their first sale, their first customer that launched the company.

Private or public, they know it’s about the customer, not the deep pocket folks.

Pedro looked at the quick and easy VC-funded approach and said, “Kinda looks like a toothpick.”

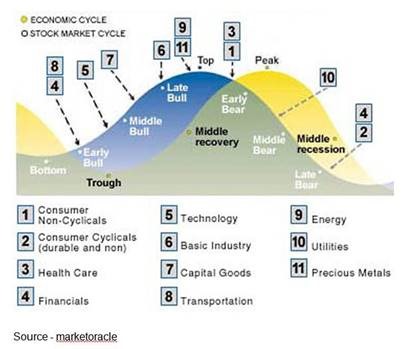

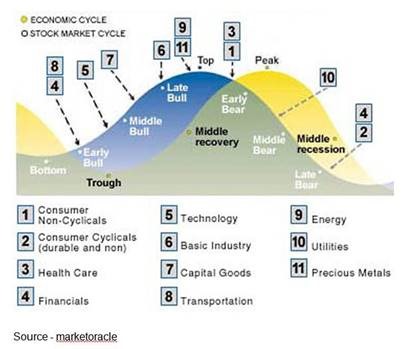

Of course there is another factor to consider – global economic cycles – that occur regularly as markets adjust to try and equalize supply and demand.

Ups ‘n Downs – Since perhaps the beginning of time there has been an imbalance in supply and demand which held sway over the price of goods, products and services. Excess demand produces higher costs, higher profits; while excess production drives prices and profits down. That may be why they’re called business cycles.

For example, when there’s a shortage of technology products – flash memory, hard drives, CPUs (central processing units), GPUs (graphic processor units), rare earth, you name it, demand and prices go up.

To get their unfair share, firms ramp up their production to take advantage of the demand and increased margins.

Then suddenly, there’s a glut. Prices go down – to keep the lines running – and margins disappear.

It happens with almost boring regularity because it’s a constant guessing game as to what’s hot, what’s not.

Of course that will never happen in the rarified game we’re playing today – you know, giant sums of money, sky-high valuations and everyone looking to score with the next blockbuster company.

Oh sure, for some it will end badly and for scores of others, it has; but most assuredly not with the one you’re in or the one your mutual fund is invested in.

After all, everyone knows unicorns don’t really exist, so how could they disappear or die?

Beautiful – Yes, we admit unicorns do look beautiful in our dreams; but unfortunately, at some point in time we have to wake up. And when we do, the pixies, mermaids and unicorns disappear; so as much as we’d like them to exist, we know they really don’t.

Man Stoner looked at what was going on and said, “I think we're parked.”

G. ‘Andy’ Marken is founder and president of Marken Communications