A couple of weeks ago, IDC released its Q2 2010 Worldwide Server Market Share Report.

My initial read was that the market was growing, and that HP was gaining share. Especially when looked from a year-over-year standpoint.

Then I started reading the news about it. Which then made it seem like I had morphed totally into The Twilight Zone or something!!!

The headlines were that HP was losing market share!

As our preferred server vendor, it was shocking. Had I missed something? Did a trend pass me by?

Aghast, I decided to look into the previous quarter’s numbers, and found out that people were either a) were sorely mistaken in their parsing of the numbers, b) read different reports, or 3) worse yet, total innumeracists!

As a public service I decided to help them out.

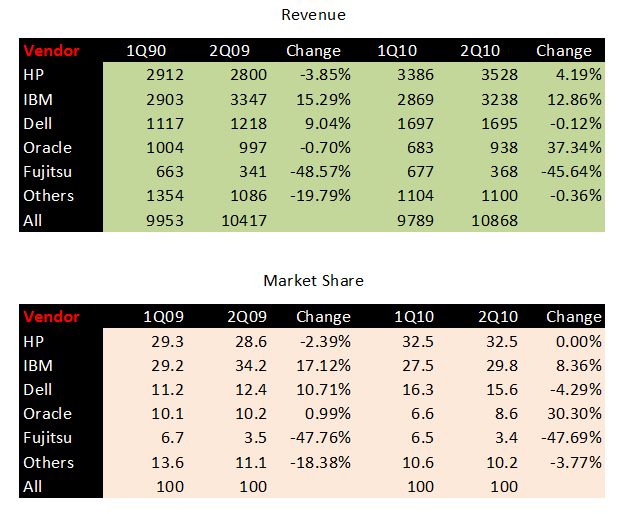

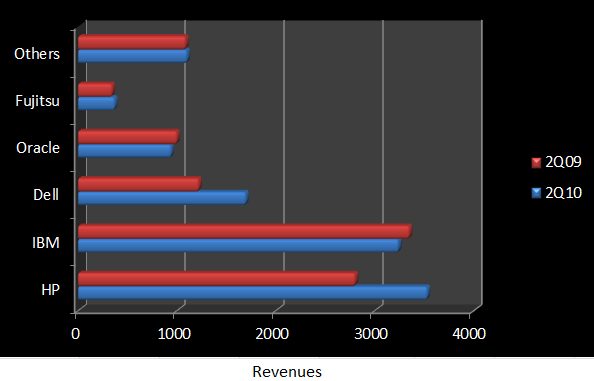

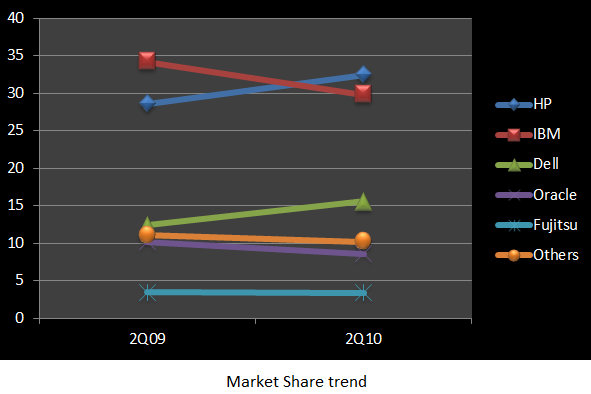

IDC 2Q2010 numbers versus the IDC 2Q2009 figures.

The revenue numbers showed that the market was booming, HP was growing, and had shaken off its customary second quarter dip for an actual growth.

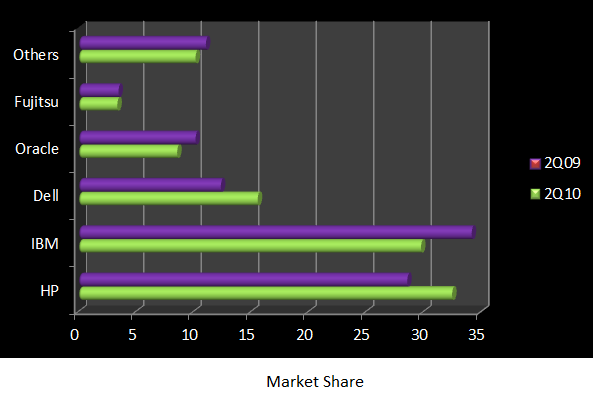

In the market share department though, HP lost 0.4% of market share.

0.4%!

A whole 0.4%!

How could they?

I am not a statistician, however, for purposes of this post, I shall play one.

Jokes aside, a 0.4% movement in any direction is statistically meaningless. Especially if you remember that the IDC numbers are just estimates. I mean, if we go with the general assumption that 1-2% per quarter is basically flat, and a 2-4% variance is within the statistical margin of error, then que pasa?

Numbers & Trends

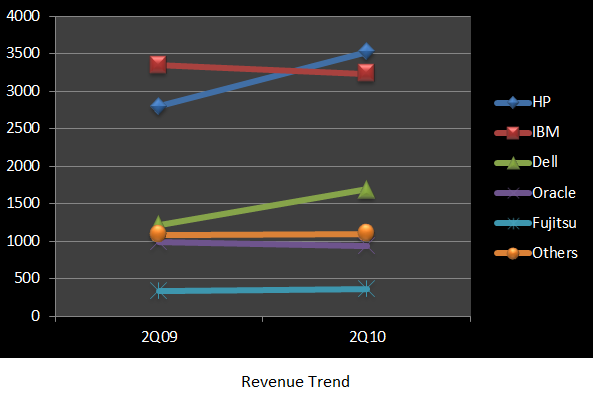

What I also like to look at is the year-over-year numbers and trends.

Was HP going to stay strong?

The raw numbers

Growth looks healthy.

Now, the trend

HP is also trending nicely here.

So, what can you say about HP chances?

As Michael J “Crocodile” Dundee might say, “Fair to middling”

What about Cisco’s UCS server systems?

Yes, what about Cisco UCS servers?

A lot of the speculation was Cisco might have been siphoning off revenue (and attendant market share) from HP.

Let me call BS on that!

To debunk it, follow closely.

In the absence of solid numbers from Cisco, the numbers floated around the Intertubes – both whisper and written – is that Cisco sold 1,000 servers in calendar year 2009.

We also know for a fact the Cisco is a very formidable competitor, imminently capable of double-digit growth even in new markets, which servers are for them.

Well, if we take that 1000-unit figure as the GAAP GARP (Generally Accepted Rumormongering Principle) number of Cisco servers sold in 2009, and unilaterally declare that Cisco is able to achieve a 99.99 percent growth quarter-over-quarter, we still come up with about 4000 servers for them. Applying a $20,000 average selling price to these 4,000 servers gives up Cisco server sales of $80 million. A mere pittance or insignificance, depending on your point of view.

That is an irrelevant amount of sales compared to the amount of ink that has been expended on Cisco’s UCS offering since its announcement.

To be fair, I want someone from Cisco to in essence, show me the money, and provide actual data before I’ll start to believe.

Conclusions

I remember reading somewhere that HP ships a server every 12 seconds or some other outrageously large number. Definitely not trivial.

That scale, coupled with innovations I have seen and also read about, tells me they are here to stay.

I’m confident.

Mentioned here

- IBM

- Fujitsu